child tax credit 2021 dates and amounts

This first batch of advance monthly payments worth roughly 15 billion. For each qualifying child age 5 or younger an eligible individual generally received 300 each month.

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

. The CTC income limits are the same as last year but there is no longer a minimum income so anyone whos otherwise eligible can claim the child tax credit. Earned Income Tax Credit. 3000 for children ages 6 through 17 at the end of 2021.

The filing deadline to submit 2021 tax returns or an extension to file and pay tax owed is monday april 18 2022 for most taxpayers. An eligible individuals total advance Child Tax Credit payment amounts equaled half of the amount of the individuals estimated 2021 Child Tax Credit. Families with 60 million children were sent the first monthly check.

The IRS pre-paid half the total credit amount in monthly payments from July to December 2021. Ad TurboTax Makes It Easy To Get Your Taxes Done Right. This tool can be used to review your records for advance payments of the 2021 Child Tax Credit.

Child Tax Credits land in families bank accounts 0030. However the irs will not issue a refund for the child tax credit. Up to 3000 per qualifying dependent child 17 or younger on Dec.

You can also refer to Letter 6419. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families have started receiving monthly Child Tax Credit payments as direct deposits begin posting in bank accounts and checks arrive in mailboxes. File With Confidence Today.

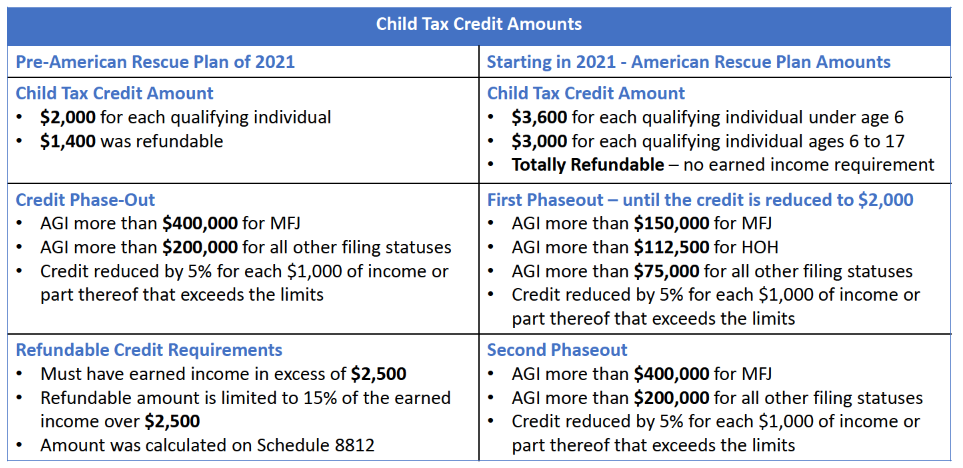

Do not use the Child Tax Credit Update Portal for tax filing information. Enter your information on Schedule 8812 Form 1040. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to.

Tax credit amount on my 2021 return during the 2022 tax filing. To reconcile advance payments on your 2021 return. For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to.

This amount was then divided into monthly advance payments. You will need to provide the number of children you have in the two age brackets - 5 or younger and 6 to 17 -. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows.

November 25 2022 Havent received your payment. The advance Child Tax Credit Calculator will provide you with the estimated credit amount you can expect as your Child Tax Credit for 2021. 15 opt out by Oct.

To complete your 2021 tax return use the information in your online account. The American Rescue Plan signed into law on March 11 2021 expanded the Child Tax Credit for 2021 to get more help to more families. Benefit and credit payment dates reminders.

Answer Simple Questions About Your Life And We Do The Rest. Up to 3600 per qualifying dependent child under 6 on Dec. 15 opt out by Aug.

15 opt out by Nov. If your child is eligible for the disability tax credit you may also be eligible for the child disability benefit. For 2021 the maximum child tax credit is 3600 per child age five or younger and 3000 per child between the ages of six and 17.

Wait 5 working days from the payment date to contact us. Because of the COVID-19 pandemic the CTC was expanded under the American Rescue Plan of 2021. In previous years 17-year-olds werent covered by the CTC.

Ad The new advance Child Tax Credit is based on your previously filed tax return. Alberta child and family benefit ACFB All payment dates. Get your advance payments total and number of qualifying children in your online account.

The expanded child tax credit of 2021 -- which increased amounts to 3600 per child under 6 and 3000 per child 6 to 17 -- will end up helping nearly 40 million families and 65 million children. For the 2021 tax year the child tax credit offers. The total child tax credit of 10500 is correct.

The payment for children. It has gone from 2000 per. Child tax credit for baby born in December 21.

15 opt out by Nov. 3600 for children ages 5 and under at the end of 2021. IR-2021-153 July 15 2021.

13 opt out by Aug. When you file your 2021 tax return you can claim the other half of the total CTC. Wait 10 working days from the payment date to contact us.

File With Confidence Today. Ordinarily the child tax credit max is 2000 which can only be claimed during tax season. Ad File 1040ez Free today for a faster refund.

29 What happens with the child tax credit payments after December. Parents with 2021 modified AGI no greater than 40000 single filers 50000 head-of-household filers or60000 joint filers wont. Did the IRS update my advance Child Tax Credit payment amounts.

Businesses and Self Employed. Learn more about the Advance Child Tax Credit. About 35 million US.

The 500 nonrefundable Credit for Other Dependents amount has not changed. Related services and information. Find COVID-19 Vaccine Locations With.

Ages five and younger is up to 3600 in total up to 300 in advance monthly Ages six to 17 is up to 3000 in total up to 250 in advance monthly Additionally a portion of your amount is reduced by 50 for every 1000 over certain income limits see the FAQs below. To date the enhanced monthly child tax credit checks have expired and will. No Tax Knowledge Needed.

For the period of July 2021 to June 2022 you could get up to 2915 24291 per month for each child who is eligible for the disability tax credit.

How The New Expanded Federal Child Tax Credit Will Work

Child Tax Credit Schedule 8812 H R Block

Did Your Advance Child Tax Credit Payment End Or Change Tas

Child Tax Credit 2021 8 Things You Need To Know District Capital

2021 Child Tax Credit Advanced Payment Option Tas

Arpa Expands Tax Credits For Families

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Child Tax Credit 2021 8 Things You Need To Know District Capital

Understanding Economic Impact Payments And The Child Tax Credit National Alliance To End Homelessness

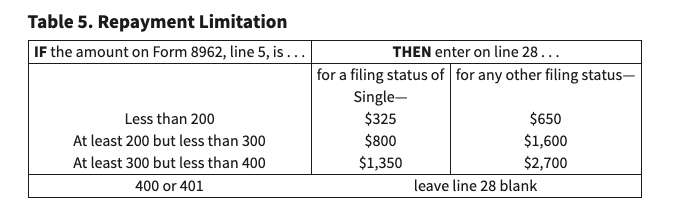

Advanced Tax Credit Repayment Limits

Child Tax Credit Definition Taxedu Tax Foundation

Child Tax Credit Update Families Will Get Paid 7 200 Per Child In 2022 By Irs Fingerlakes1 Com

Childctc The Child Tax Credit The White House

Why Is There No Child Tax Credit Check This Month Wusa9 Com

The Advance Child Tax Credit An Opportunity For Hud Assisted Families With Children Hud User

Tax Tip Caution Married Filing Joint Taxpayers Need To Combine Advance Child Tax Credit Payment Totals From Irs Letters When Filing Tas

Irs Sends Millions Letters About The Monthly Child Tax Credit Payments Forbes Advisor